Your Due Annuity Account comes with a 3% guaranteed interest rate on your money. No hidden fees. Just a simple retirement plan for people like me and you.

An annuity manages the risk that you’ll outlive your savings or that a financial collapse might reduce their value. You invest a lump sum amount in exchange for monthly payments over many years. No matter how long you live, you will still receive income.

An annuity is a contract with an insurance company. Insurance products are designed to manage risk. Flood insurance, for example, lowers the risks that a homeowner will face large expenses if a pipe bursts or a roof leaks. The insurance company accepts the risk that it might make payouts greater than the value of its clients’ savings.

In this guide, we’ll look at the pros and cons of annuities due. We’ll discuss the options and the values, and we’ll explain what you need to know as you consider using this financial tool to give yourself a more secure financial future.

While all annuities swap a customer’s payments for a future return, annuities come in a range of different versions. In addition to being either deferred or automatic, they can also be variable or fixed, and they can be limited and set for life. Their values vary over time and the rates that they deliver to customers can also vary between insurance companies.

As you consider adding an annuity to your financial toolbox, we’ll make sure that you have the information you need to decide whether this tool suits you and which kind of annuity suits you best.

Before getting too far ahead of ourselves, let’s quickly explain what an annuity is.

Believe it or it’s actually an insurance product. Specifically, it’s a contract between you, the annuitant, and an insurance company where you’ll make a single payment or series of payments, also known as premiums. In return, you’ll receive regular disbursements that begin either immediately or sometime in the future.

That may sound confusing. And, that’s to be expected. After all, annuities can be very complex. So, the easiest way to think of an annuity is when you purchase travel insurance or a warranty on a new vehicle. They offer protection in case your trip gets canceled or your car breaks-down. Annuities guarantee that you’ll receive a steady income for the rest of your life.

Because of this, annuities are often used as a way to save for retirement. When you go this route, you’re essentially paying an insurance entity to grow that money. And, more importantly, send you payments when you retire.

However, some prefer to convert their savings into a stream of retirement income. But, you do have the option to do both. If so, the insurance company will delay the pay-out until the future.

While this might be a lot to wrap your head around, the main takeaway should be this; with annuities, you pay an insurance provider. As a result, they’ll assume the risk of you outliving your retirement savings if you happen to outlive your income. What’s more, you’re also safe from market risks.

Today we’re going to teach you about an Annuity. Regardless of your financial goals and status, everyone needs to have a plan for retirement. Unfortunately, 64% of Americans have reported that they are not prepared for retirement. More troubling is the fact that 48% don’t even care.

While there are a variety of reasons, like not having enough money to save, the fact is you need to think about your retirement yesterday. Even if you begin stashing money away in a savings account each month is better than nothing. At some point though, you are going to have to step-up your retirement plan by investing in retirement savings vehicles like a 401(k) or an IRA.

But, have you also considered additional retirement plans like annuities? If not, you may want to. Although frequently misunderstood, it can be an effective way to generate a stream of lifetime income — guaranteed.

If that sounds too good to be true, then dive into the following annuities guide. It will explain everything that you need to know about annuities so that you can determine if they fit into your retirement plan.

Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy.

The key advantage of an annuity is that it guarantees recurring payments for either a specific period of time or the rest of your life. Having a reliable income stream, in addition to vehicles like a 401(k) or Social Security, eliminates the risk of outliving your savings. And, in the post-pension age, this is a major advantage.

Another perk is that most annuities offer premium protection. That means you will never lose the amount you initially invested.

Providing lifetime financial security in exchange for sacrificing liquidity is perceived by some investors as an unfair trade-off. Having said that, if your short-term or long-term goals are limiting your cash flow, an annuity is most likely not the best financial option for you. After all, when you don’t find a product that’s valuable or viable for you, it doesn’t make much sense for you to purchase it.

Other drawbacks to annuities include;

Another critique is losing potential returns. Known as “opportunity cost,” this is frequently considered a negative as you may not be able to pursue more fruitful investment options since it’s difficult to make a withdrawal. Risk-averse people, however, will find this objection valid. On the flip side, younger investors with longer investment horizons have more time to invest. As such, it’s easier for them to bounce back from temporary market losses if they’re following an aggressive investment strategy.

In contrast, pensioners and older investors should assess opportunity costs. Specifically, in relation to their specific circumstances. A decline in opportunity costs is less likely to be considered a major disadvantage of annuities among this particular age group.

You can invest as much as you would like each month, no limits. The more you invest, the more you’ll get each month when you retire.

Here are a few annuity recommendations/suggestions we’ve seen as general guidelines to help you retire comfortably:

Want to cash-out your annuity? You can cash out at any time. Yes, there are a few fees to bring out your money early. Typically this ranges from 8% – 10% as your money is invested in . The reason we have these fees is because we’re investing your money in long term assets. To exit these assets involves fees. The longer you have your money invested, the lower that fee becomes.

Contributions |

||||

|

||||

|

||||

|

||||

Rates & Ages |

||||

|

||||

|

||||

|

||||

|

||

Annuities are a way to turn a sum of money into revenue, often to supplement a retirement income. They’re long-term investments aimed at people looking for financial security.

You can buy an annuity from an insurance company, paying in advance over a long period or with a single lump sum. The payouts can start immediately or you can defer them until your payments have accumulated. The result should be a predictable income for life or for a set period.

The period when annuity owners pay premiums and build their annuity nest egg.

The conversion of the annuity payments into an income stream.

Payouts can have fixed rates or they can rise and fall in line with the performance of financial markets.

Riders customize annuity contracts. They might allow beneficiaries to inherit an income, for example, or guarantee a minimum income stream. They usually come with fees.

The period following accumulation and annuitization when the insurance company gives the annuity owner an income.

You can make annuity payments with pre-tax dollars, only paying income tax during the payout phase when your income is likely to be lower. If you pay with post-tax dollars, you’ll only have to pay tax on the earnings.

Annuity payouts can be immediate or deferred. Your choice will depend on your stage of life, the status of your savings, and the reason you’re considering an annuity.

Immediate annuities deliver a revenue stream within a year of the purchase of a policy.

Deferred Annuities deliver a revenue stream years—often decades—after the initial purchase of the policy.

An immediate annuity begins making payouts without an accumulation phase. Instead of paying a premium every month for several decades, you give the insurance company a lump sum and begin receiving a regular income right away. Immediate annuities make up about 10 percent of annuities sold.

Like other annuities, immediate annuities can offer various payment schedules, payout periods, and inheritance riders. They can also be fixed or variable.

The biggest benefit of an immediate annuity is that it allows new retirees with significant savings but small retirement funds to supplement their retirement income.

A deferred annuity makes payouts after an accumulation phase. During the accumulation phase, the premiums grow on a tax-deferred basis, lowering tax liabilities when your income is at its highest, and providing an opportunity to pay income tax at a lower level.

An immediate annuity provides one way to save for retirement, supplementing other retirement funds such as a 401(k) or an IRA.

Insurance companies make annuity products in different forms to suit different buyers and meet different preferences. The most common forms include:

Fixed annuities promise a guaranteed interest rate. Instead of the growth rate of premiums rising and falling in line with the performance of the market, a fixed annuity offers a standard rate, often around 3%. They make planning for the future easy and predictable.

Variable annuities link the growth rate of an annuity to an investment vehicle. That vehicle might consist of a mixture of bonds, stocks, and fixed interest accounts but the value of the fund will rise and fall in line with the market. Variable annuities are unpredictable but they can produce higher growth than fixed annuities.

Annuities deliver a range of benefits. Consider an annuity if you’re looking for one or a combination of the following returns:

Immediate annuities are popular with people on the edge of retirement who want to swap their savings for a guaranteed income. Deferred annuities allow people to put aside income on a tax-deferred basis and add another revenue stream to their retirement fund.

Imagine that you’re 67 years old. You’re about to retire. You have some savings but you’re worried that your 401(k) and your IRA won’t give you enough to retire comfortably. How much would your income rise if you swapped $100,000 of your savings for an immediate annuity?

The payout will vary from insurance company to insurance company. It will also depend on the riders you attach to the annuity. Guaranteeing a payout for a period of time, such as 10 or 20 years, will affect the payout. So will including a death benefit or covering the lives of a couple rather than a single individual. The sex of the primary annuitant matters too.

According to one annuity calculator, a $100,000 fixed income immediate annuity would deliver between $433 and $474 a month for a single life.

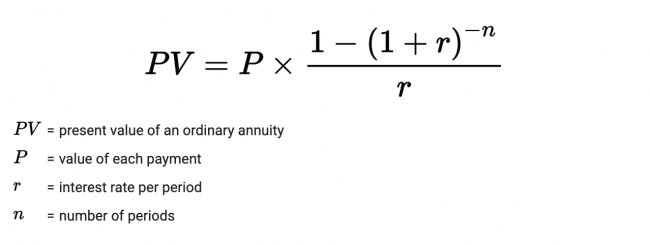

Here is the official annuity formula:

Annuities give savers a number of important benefits. Unlike 401(k) plans and IRAs, they have no contribution limits. Annual contributions to a 401(k) max out at $19,500 with up to $6,500 of catch-up contributions for people aged over 50. IRA contributions are limited to just $6,000 a year, or $7,000 for the over-50s. Annuities can take any contributions at all.

They can also produce a reliable revenue stream, reduce tax bills, and give people who haven’t funded their retirement accounts sufficiently a way to retire.

Buy an annuity that suits your needs. Put aside as much as you want each month or convert as much of your savings as you want into a monthly income. Annuities have no limits.

Annuity contributions are tax-deferred. Make your contributions with pre-tax dollars and you’ll only pay income tax on that amount during the payout phase. Make your contributions with after-tax dollars and you’ll only pay tax on the earnings.

Annuities let you turn a lump sum into a guaranteed revenue stream. An insurance company manages your savings and gives you a monthly income.

Riders in your annuity can guarantee an income for the rest of your life and ensure that beneficiaries also inherit some of the fund.

Annuities can be useful tools but they’re not for everyone. They do carry a number of disadvantages that need to be considered as you weigh up whether or not to buy an annuity.

Money placed in annuity is locked up. You won’t be able invest it in other vehicles that could earn more, or benefit from a rise in interest rates.

Annuities deliver security, not a promise of high returns. Payouts are often conservative in comparison to other investment plans.

Insurance companies make their money out of fees and commissions. Those expenses vary with the nature of the annuity but a savvy investor might be able to get a similar return themselves without the fees.

The range of riders and options offered by insurance firms can make decision-making difficult. You might find yourself wondering how long you have to live and how much you should leave your heirs.

As you weigh up buying an annuity, there are a number of issues you should consider.

If you’re buying an immediate annuity, aim to balance a high monthly income with access to liquid funds. The more you invest, the higher your income will be but you will also need some savings for one-off expenses.

Riders affect the size of the payout. The more security you add to your payouts and the more benefits you want to leave to your beneficiaries, the lower your payouts will be.

One of the biggest benefits of an annuity is that it delivers a reliable income. If you can tolerate some risk, though, a variable rate annuity might deliver a higher return.

Annuities have expenses. Different plans will charge different rates and offer different returns. It’s worth shopping around to make sure that you’re getting the best return for your money.

Annuities have expenses. Different plans will charge different rates and offer different returns. It’s worth shopping around to make sure that you’re getting the best return for your money.

To start investing in an annuity, contact us today. We’ll walk you through the options and help you to find an annuity that’s right for you.

Annuitant

The payout value of an annuity is based on the life expectancy of the annuitant.

Annuity Rate

The annuity’s growth rate. The rate may be fixed (such as 3% annually) or variable, changing with the performance of the financial markets.

Cash Surrender Value

The amount that the annuity holder can withdraw from the contract early after the deduction of surrender charges.

Fixed Period Annuity

A payout phase limited by a number of years instead of the owner’s lifetime.

Free-Look Period

The number of days during which an annuity owner can cancel the contract. You might have as little as 10 days to cancel the purchase of an annuity.

Income Floor Guarantee

A guarantee that a minimum percentage of the investment will be paid out. A contract might promise to pay back 80% of the value of a variable rate annuity, for example.

Non-Qualified Annuity

An annuity purchased with after-tax dollars. Tax on the fund’s earnings only become payable during the payout phase.

Split Annuities

A split annuity is a combination of a deferred annuity and an immediate annuity. When the immediate annuity is exhausted, payouts begin from the deferred annuity.

Planning for your retirement is never easy. It’s the kind of thing that you feel you can always put off. If you’re employed, your company probably deals with at least some of it, putting a portion of your salary in a 401(k). If you’re lucky, they’ll also offer to add a bit extra in matching funds. And if you’re really lucky someone will have advised you to make the most of those matching funds. You might not be able to access that income now but there’s little point in leaving money with your employer that it’s willing to give to you.

Even if you have a 401(k) plan though, those funds might not be enough to give you the retirement you want. You might also have set up an IRA, an Independent Retirement Account, that lets you put away even more money for the future on a tax-deferred basis.

Both a 401(k) and an IRA though have limited contributions. You might not be able to put all of your savings into those accounts. And let’s face it, not everyone is as diligent as they should be about saving for the future. According to some studies, the median amount in a 401(k) at the age of 65 is less than $65,000.

That’s not going to provide much of a retirement income which is why many people turn to annuities.

You might not have put much into your retirement funds but if you have savings in a different form, you can still turn your funds into a regular income.

That’s often how people see annuities: as a way to ensure a fixed income late in life. But there’s a lot more to it than that. Today we’re going to teach you a few things people miss when looking at annuities. Here are 15 facts that you might never have known about annuities but should before you invest.

Most retirement funds come from financial organizations. Those organizations pick the funds in which to make the investments, track the markets, and make any necessary adjustments. Their fees are based on their ability to understand stocks and bonds.

Although annuities do depend on the performance of financial markets, they also require an understanding of actuarial science that’s usually confined to insurance companies. The seller of an annuity needs to be confident that the total amount that they’ve agreed to pay each month to the annuitant is not greater than the total value of their savings. That means being able to calculate the life expectancy of the annuitant.

Instead of thinking of an annuity as an investment product then, it’s more accurate to think of it as a kind of insurance policy. Just as you can pay an insurance company to remove the risk of a large expense should your home burn down, you can also pay an insurance company to remove the risk that you’ll outlive your savings.

The manner of paying might feel different. Life insurance, for example, requires paying small amounts each month so that beneficiaries can receive a single return in the event of your death. An annuity might require paying small amounts over years but the payments stop when regular payouts begin. They might also require the payment of a single, large, lump sum, with returns beginning immediately.

However you pay, you will be buying an insurance product designed to ensure that you don’t outlive your savings, not just an investment product.

Although the government wants people to put aside money for their retirement, it doesn’t want them to put away too much money for their retirement. Because payments can be tax-deferred, an absence of contribution limits might allow high-earners to save large parts of their salaries without paying tax on them until their income is much lower. Contribution limits cap the amount of tax that earners can defer.

The contribution limits change every year or two. In 2021, they’re no more than $19,500 a year for 401(k) plans with an additional $6,500 in catch-up contributions available for people aged 50 or older. For IRA accounts, the limit is even lower. They’re $6,000 a year, or $7,000 for the over-50s.

That means that you can’t usually put more than $1,625 a month into your 401(k) or more than $500 a month into your IRA.

Together those payments might be enough for you. Depending on when you start contributing, those savings might just compound enough over the years to give you a reasonable retirement.

But annuities give you an additional option—and there are no limits at all on the size of the contributions you can make to an annuity. That doesn’t mean that you should put all of your spare money into an annuity. But it does mean that you have options. You can save your funds. You can prepare for the future. And you can still do it on a tax-deferred basis, reducing the amount of taxes that you have to pay today until you’re in a lower tax bracket in the future.

Annuities let you save more for your retirement than other funds and they let you lower your taxes.

Retirement funds such as a 401(k) and an IRA work by taking contributions from savers, investing them in the financial markets, and growing them until the saver retires. At that point, the fund manager pays the saver a monthly amount based on the rate at which the fund continues to grow. The financial company takes no risk. The days in which company pensions guaranteed a payout regardless of the saving rate or the growth rate are largely over—at least in the private sector.

Annuities work by transferring payout risk to the insurance company. Unlike other insurance products, the customer doesn’t pay continuously. Once they reach the payout phase, they stop paying and start receiving. The insurance company calculates the annuitant’s life expectancy and provides a monthly payment based on the size of the savings fund and that life expectancy. The fees that the annuitant pays to the insurance company act like a premium ensuring that the payouts continue if they’re fortunate enough to live beyond their life expectancy

One way in which annuities differ from other retirement funds is that they can start paying out as soon as you make the payment. It’s a special feature which means that they can act as valuable additions to your retirement income.

For both 401(k) plans and IRAs, you can expect to make monthly payments over many years. The funds will build up in your account, accumulating compound interest, and growing on a tax-deferred basis until you’re ready to retire.

The challenge, though, is figuring out how much you should put away each month. Save too much and you’ll sacrifice experiences and spending power when you’re young in favor of extra money when you’re older and might have less need of it.

Save too little, though, and you’ll reach retirement facing an income too small to live on comfortably.

An immediate annuity can help to make up the difference. As long as you’ve also saved money over the years, you can turn those savings and investments into a monthly income that’s guaranteed to last the rest of your lifetime. As you put money into your retirement fund, you’ll be able to be cautious, knowing that you can make up for lost savings.

An immediate annuity will let you swap those savings for extra retirement income.

A major benefit of an annuity is reliability. Whether you’re saving money each month or sitting on a nest egg that you’ve built over the years, you can’t know how much income those savings will give you when you’ve retired. The results will depend on your investment strategy and the performance of the markets.

A fixed rate annuity gives you security by promising a predictable rate of return.

But you don’t have to take a fixed rate annuity. Variable rate annuities can deliver higher incomes that more closely match the performance of the market. They’re not predictable. You could end up with a lower income than you’d hoped. But if you can afford the risk and are willing to accept volatility, you can try to get more out of the market than a fixed rate annuity will deliver.

Put money each month into an annuity and the insurance company will lock that money away. You will be able to withdraw your funds before the payout phase but only after paying a fee.

Those fees take three forms.

The first is ordinary income tax. Because you won’t have paid income tax on the money you put in the annuity, you will need to pay that tax when you take it out of your annuity.

In addition, the government will also levy a 10 percent federal income tax if you’re taking the funds out before the age of 59.5.

Finally, the insurance company will levy its own surrender fees. These vary, and tend to decrease the longer you keep your money in the annuity. An insurance company might charge as much as 6 percent for money withdrawn in the first year of the annuity period, 5 percent in the second year, and so on.

Most annuities, though, will offer a “free withdrawal provision” that waives the surrender fees as long as less you’re withdrawing no more than 10 percent each year. You will still have to pay the taxes though!

The idea is to ensure that the insurance company can recover the cost of creating the annuity contract and manage investments that are meant to be long-term.

Those fees, though, do mean that you should think carefully about putting your money in an annuity. Make sure that you only invest funds that you’re unlikely to need before you retire.

Variable rate annuities let you benefit from movements in the market. If the financial markets do well, your annuity will grow—and should perform better than a fixed rate annuity with a predictable rate of return. You’ll also have more control over where your money is invested. By choosing the kind of investment sub-account you want, you’ll be able to select a volatility range and risk level that suits you.

The downside is that you won’t know how much your monthly payout will be until you retire.

But even a variable rate annuity won’t match the markets completely. You’ll be investing through an insurance company which will charge its own management fees. Those fees are often higher than those charged by investment companies.

If you want your savings to grow in line with the financial markets, you might be better off investing in a market tracker—then cashing in your savings at retirement in favor of an immediate annuity.

Retirement saving in general is tax-deferred. The money you place in a 401(k) or an IRA is pre-tax dollars. You only pay income tax on those funds when you receive them during the payout phase. At that time, you’ll have retired and your income will be lower, reducing your tax bill. People who expect that their income will be higher when they retire can use a Roth 401(k) or Roth IRA. They’ll pay their income tax first but they won’t have to pay income tax during the payout phase.

Those tax deferments are limited. Because you can’t usually contribute more than a total of $2,125 into your IRA and 401(k) accounts every month, you can’t use those accounts to reduce your income tax payments any further.

You can, however, use your annuity payments to continue reducing your tax liabilities.

There are no limits on annuity contributions, which means there are no limits on the amount by which you can reduce your taxes—at least in the short term. Bear in mind that you will pay income tax when you receive the payout, and you’ll pay a tax penalty if you withdraw your funds early.

The downside is that you won’t know how much your monthly payout will be until you retire.

But even a variable rate annuity won’t match the markets completely. You’ll be investing through an insurance company which will charge its own management fees. Those fees are often higher than those charged by investment companies.

If you want your savings to grow in line with the financial markets, you might be better off investing in a market tracker—then cashing in your savings at retirement in favor of an immediate annuity.

Think of death riders and you might imagine a violent biker gang—the kind of thing you probably want to avoid. In annuities, though, a death benefit rider ensures that beneficiaries can inherit some of your annuity. If you die before the annuity has paid out all your savings, the insurance company won’t be able to keep it, and your beneficiaries will receive an inheritance. It’s a useful way to remove the risk of swapping your life savings for only a few monthly payments.

You can also purchase living riders that benefit you during your lifetime. A cost of living adjustment rider, for example, adjusts a fixed income to stay in line with the rising cost of living. Other riders include a guaranteed minimum withdrawal benefit which lets you withdraw a percentage of the annuity’s principal each year, while a commuted payout rider grants lump sum withdrawals. A disability income rider can raise your income for a period in the invent of a disability that affects your income, and a long-term care rider will help to pay for the increased cost of long-term care.

Because insurance companies can figure out actuarial risk, they’re able to combine insurance-type products with their annuity payouts.

Insurance riders offer a range of different features and options but they do increase the cost of the annuity and can lower the payouts that you receive.

That makes choosing your riders difficult. A death rider removes the risk that you’ll give an insurance company several hundred thousand dollars and only receive a few thousand dollars in return. It takes your remaining premium out of the hands of the insurance company and makes sure that it goes to your beneficiaries. But a death rider typically costs anywhere between 0.25% and 1.15% of the value of the annuity. As you start to add other riders—a cost of living adjustment, for example—the cost increases even further. They’ll combine with the insurance agent’s management fees to continue reducing your payment and limiting the value of the returns on your savings.

Ask your insurance agent which riders they offer but make sure that you choose the riders you want wisely.

Fixed index annuities provide predictability and stability. Variable rate annuities provide a chance of higher returns at the risk of a market collapse that lowers returns.

One alternative to both of those options is indexed annuities. These kinds of annuities guarantee a rate of return and they track their gains according to a particular index such as the Dow Jones.

You’ll get a guaranteed minimum payout and the option of more if the market does well. But there are a couple of drawbacks.

First, the price for that guaranteed floor is usually a cap on the gains. You might only receive 80 or 90 percent of the rise of an index, for example. Or the annuity could limit your interest rate raise. The market could jump 15% in a year but if your gains are capped at 6%, most of the value of that rise will go to the insurance company.

Second, the way the insurance company calculates the index’s gains matter too. Some companies might only look at the index’s annual change. If the index climbs 20% over the year then falls 18% in the days before the insurance company calculates the index’s return before climbing another 10% in the days after, your gain will only be 2%. Indexed annuities miss the benefits of index peaks.

They also don’t usually provide complete guarantees. A floor should ensure a minimum level of payout regardless of the performance of the index. But one way the insurance company covers its risk is by only applying that guarantee to some of the premium. It’s not unusual for as much as 13% of the premium you’ve paid to be excluded from the guarantee, lowering the floor further.

That doesn’t mean that you should never take an indexed annuity but you should know what you’re buying. If you want to track an index, it’s often wiser to invest in a tracker fund, then buy an immediate annuity.

Insurance companies offer annuities because they have the actuarial skills necessary to calculate payouts for the rest of your life. They’re able to factor in your age, health, medical history, and so on in order to work out the probability that you’ll reach a particular age. They can then use that probability to calculate how much they can pay you from your premium each month for as long as you’re likely to need those payouts.

That’s not a specialty in which financial investment firms excel, which is largely why they don’t offer annuities. It doesn’t mean that the insurance company literally knows when you’re going to die. But it does mean that they know when you’re probably going to die.

The money that you place in your 401(k) has some protection. 401(k) plans usually qualify under the Employee Retirement Income Security Act. If your employer goes out of business, your 401(k) will be unaffected. You’ll still receive your payouts when you retire. If you yourself enter bankruptcy, the funds in your retirement accounts will not be accessible to creditors. Your retirement money is yours.

Protection for annuities is more complicated.

The danger to an annuity comes from the collapse of the insurance company that provides it. While the federal government protects consumers if a bank or financial brokerage collapses, that protection does not extend to life insurance companies.

The first thing to note though is that such failures are very rare, and they’re even rarer among large corporations. When an insurer does start to run into trouble, the state’s regulator will begin working with the National Organization of Life and Health Insurance Guaranty Associations to find another company to take over. Usually, the annuity then passes to the company’s new owner, and customers experience no change in service. Scheduled annuity payments will continue as always. Customers who want to take lump sums might experience some delays as the takeover is negotiated.

If another company doesn’t take over the failing insurance firm, protection from the state’s guaranty fund depends on the state and on the type of annuity. For deferred fixed annuities, the guaranty association limit will only reach the current value of the annuity after surrender charges. For variable rate annuities, the protection is often weaker because the insurance company has less liability.

Before you buy an annuity, ask about the protection available for that product if the company collapses. Check the small print, and if you’re still uncertain, you can contact the National Organization of Life and Health Insurance Guaranty Associations for help.

Saving for retirement is like planting trees. The best time to begin is usually several years ago. The second best time is always now. For annuities, especially fixed rate annuities, timing can appear to be an issue. The interest that fixed rate annuities earn is based at least in part on 10-year Treasury rates. Those rates are currently around 1.6%, far below their long-term average of 4.36%. It might make sense then to wait and only purchase a fixed rate annuity when interest rates rise again.

But there’s no way to know when that will happen, and in the meantime you’d be missing out on the growth opportunity and the security that the annuity will bring.

The right time to buy an annuity has nothing to do with interest rates or market performance. Annuities aren’t competing with other financial products on their rates of return. Their key function is to allay risk. They ensure that you will have a retirement income for the rest of your life.

The best time to buy an annuity then is the moment you feel that you want the security and predictability that an annuity can deliver. And remember that you can always start small and build over time. That applies to both deferred and immediate annuities. If you’re buying a deferred annuity, you can increase your payments as your income and interest rates rise. If you’re buying an immediate annuity, you can swap some of your savings for an income now, then buy a larger annuity later if you want to increase your retirement income.

Match the timing of your annuity purchase with your attitude towards income risk. That’s much easier to assess than Treasury rate rises.

Everyone needs retirement income. Every employee should be making the most of their company’s 401(k), maxing their matching contributions, and enjoying the benefits of tax deferment. But that doesn’t mean that everyone should have an annuity.

Annuities deliver a guaranteed income after retirement for the rest of your life. They’re suitable for people who worry that they might not have saved enough to give them a good enough income when they stop working. They’re not suitable for people who, for health or other reasons, have a lower than average life expectancy or for people who have enough other income streams to ensure a good retirement income.

Talk to a financial advisor before purchasing an annuity and make sure that the product matches your attitude towards risk and retirement.

Annuities are contracts between an individual and an insurance company. When people retire, they're usually able to draw a steady income from annuities. What’s more, annuities can be used to protect a person against outliving their savings.

The income from annuities is guaranteed for life, unlike other retirement vehicles. This makes them a good option to supplement other retirement income streams like a 401(k), IRA, or Social Security.

A person usually makes payments to an insurer either in a series of installments or all at once. Following that, they receive regular payments from the insurance company, beginning either at a later date or right away. Individuals can choose to receive distributions for a set period, such as 30 years, or for as long as they live.

Various types of annuities are available, each offering unique characteristics for people of different financial situations. Moreover, the withdrawal method depends on the type of annuity you hold.

In addition, annuities provide you with the option of choosing how your money grows;

An immediate annuity cannot be withdrawn before a specified period of time. Upon paying the insurance company the lump sum payment, you will begin receiving a monthly income stream for a specific period of time. It is not possible to change this decision.

Deferred annuities do, however, permit early withdrawals before you start receiving payments. This holds true regardless of whether the annuity is fixed, variable, or fixed index.

The benefit of an annuity is that it offers guarantees to safeguard your nest egg, which may not always be the case in certain scenarios. Ultimately, however, an annuity serves as a financial product that can help you save for retirement or provide you with a regular income during your retirement years. As such, with most annuities, you can’t lose any money. However, there are some exceptions to the rule.

A variable annuity has the potential to lose money. Like mutual funds, variable annuities do not protect your principal or investment gains from market fluctuations. The carrier will invest your money in mutual funds when you invest in variable annuities. Based on the performance of those investments, the value of your annuity changes. Likewise, your variable annuity value will rise and fall with the value of your investments. Consequently, if the investments in your account do not perform well, you may lose money, including your principal. In addition, variable annuities have higher fees, which increases the risk of loss.

While annuities are subject to many legitimate concerns, it's important to note that there can be potential upsides. But, this depends on your specific financial circumstances and financial goals. Generally speaking, though, an annuity can be a good investment.

The primary benefit of an annuity is that it assures you a steady income. An annuity is a very stable investment since the insurance company is required to pay you the amount agreed in the contract even if the market crashes. It is possible, however, that you will not be compensated if the insurance company shuts down. Therefore, you should work only with reputable and stable insurance companies that have a strong rating from any of the four major insurance company rating agencies in the U.S.; A.M. Best, Moody's, Standard & Poor's, and Fitch.

The fact that many annuities come with customizable money management features may also make them a good investment. If the market is down, you can include things like minimum income benefits, which ensure a certain payout even if the market is declining. As long as your spouse is still alive, you can also add a spousal provision, allowing payments to continue even after your death. Accordingly, upon the death of the annuitant, beneficiaries can inherit the remaining value of the annuity.

At the same time, you shouldn't invest in an annuity solely for retirement. You may, however, use it as part of a larger retirement plan.

If, for example, all of your retirement account options have already been exhausted, an annuity may be your last resort. If you receive a large sum of money, an annuity may be a good choice. The reason for this is that an annuity prevents you from spending this windfall of cash too quickly and carelessly as you can receive payments over a specified period.

Annuities are often marketed as investments by insurance companies. However, they are in fact insurance products. And, more specifically, at their core, annuities are nothing more than a guarantee.

When you pay an insurance company an annuity premium, you're guaranteed that you'll get your money back. Oftentimes, you'll even receive a little bit more. Alternatively, you earn money while also receiving a regular check for a certain amount of time.

Similarly, you buy an annuity to protect yourself from outliving your money, just as you purchase life insurance to protect yourself against financial disaster. Having such financial security is appealing. And, it’s also a guarantee that other retirement products, like a 401(k) can offer as they can fluctuate frequently with the market.

However, annuities can also be complex because there are a variety of options. But, the first place to start is understanding the difference between an immediate and deferred annuity.

The difference has to do with when you start receiving payments. With an immediate annuity, you’ll pay a one-time lump premium to an insurance company. The income source will begin immediately or very soon thereafter. Deferred annuities let you invest now, or over a period of time, and receive payments later.

There's more to buying an annuity than deciding if you prefer an immediate or deferred annuity. You also must consider these options:

Joint and lifetime income. Maintain income during your lifetime and the life of your spouse.

Annuities can be either immediate or deferred when planning your retirement. Their principal difference is when they begin paying out. Your particular financial goals will determine whether you choose immediate or deferred.

Immediate Annuity

With this approach, you can convert a lump sum of money into an annuity, allowing you to receive income immediately. Payments usually begin about a month after the annuity is purchased. An immediate annuity also provides you with lifetime income payments as a way of protecting your financial security since you can't outlive the annuity.

The benefits of immediate annuities include:

There are both fixed and variable immediate annuities. A fixed annuity income payment is based on your contribution, your age, and the interest rate at the time you purchase it. As such, it never fluctuates. A variable immediate annuity income payment varies based on your investment choices.

Deferred Annuity

Annuities of this type are a good investment for long-term retirement planning because:

Deferred annuities can also either be fixed or variable. Another option is indexed annuities. If you want to grow your investment, this is a better option. As an example, any returns are connected to the performance of market indexes, such as the S&P 500. There will be multiple time horizons involved, with the insurance company providing 100% principal protection.

Let's say you're 67 years old. Retirement is just around the corner. There is some money in your 401(k) and your IRA, but you are worried that it won't be enough to live comfortably in retirement. If you converted $100,000 of savings into an immediate annuity, would your income increase?

Depending on the insurance company, the payout may differ. Riders added to the annuity may also influence it. If you guarantee the payout for a period of time such as 10 or 20 years, the payout may be affected as well. Likewise, covering the lives of two individuals rather than a single individual would be advantageous. And, the gender of the primary annuitant is also important.

One annuity calculator estimates that a $100,000 fixed income immediate annuity would provide a single person with around $433 to $474 a month.

As a rule of thumb, the sooner you receive a payment stream from an annuity, the more you will get. As an example, annuity payments due to arrive within five years are worth more than ones due within 25 years. The following formula can be used to determine an annuity's present value if you want to figure it out on your own:

PV = dollar amount of an individual annuity payment multiplied by P = PMT * [1 – [ (1 / 1+r)^n] / r] such that;

Annuity purchasing companies are usually required by law to disclose the difference between the amount you are offered and the present value of your future payments.

Here is a good breakdown on how an annuity works to help you understand all aspects of an annuity.

It's pretty straightforward to get started. After you click on the signup button, fill in all the information that we require for setting up your Due retirement account, and then select how much money you would like to deposit into your account on a monthly basis. It usually takes about ten minutes to complete the setup process.

Our team at Due will invest the money you entrust us with once your account has been set up. Just note that you'll have to pay $10 a month for Due. Proceeds are used to expand and manage the business.

Due offers a guaranteed 3% interest on all the money you have deposited. Your money is then invested so we assume the risk. There is no difference between the amount you receive and the amount you lose. To minimize risk, your money is placed in the Charles Schwab account with two of the most reputable investment firms in the nation: Blackstone (NYSE: BX) and ATHOS Private Wealth.

Whenever you want, you can see the amount of money you'll receive for the rest of your life with Due. Upon reaching 65 years of age, or any age of your choosing, you’ll receive a “deposit” into your bank account on either the first or 15th of each month.

Withdrawal of funds is possible at any time. We typically charge a 10% penalty fee if you withdraw your money before you reach 65. Due to the fact that we have invested your money in longer-term investments with high penalties for withdrawing it, it cannot be taken out quickly. We are able to deliver predictable returns for our customers when we invest the money this way. For withdrawals before age 59 ½, an additional 10% IRS penalty tax may apply.

One of the most attractive aspects of annuities is the fact that you will receive regular payments from the insurer. During retirement, you can supplement your Social Security and pension benefits with these recurring payments. Having this knowledge will also help put your mind at ease if you're worried that you won't be able to cover your regular expenses with your savings. An annuity seems like a wise decision when you consider that outliving your savings is a concern for half of American adults.

In most annuities, you will receive a guaranteed lifetime income, but you can specify how long you want the payments to last. The value and amount of your annuity payments may also change over time. You should check the contract you have and the type of annuity you purchased to find out if this applies to you.

Another advantage of annuities is their premium protection. This means that you will never lose your original investment. You’re guaranteed a minimum return on your investment if you invest in a fixed annuity, for example. You won’t receive the most generous returns. Nevertheless, it is safe, secure, and predictable. No matter what, Due provides a 3% return on every deposit.

Those aren’t the only benefits of annuities, though. Additional annuity advantages include;

It is perceived by some investors as unfair to trade lifetime financial security for sacrifices in liquidity. However, if your short-term or long-term financial needs are limiting your cash flow, an annuity is not likely to be the best solution.

In fact, an annuity's main criticism is that you are unlikely to have easy access to your money. Withdrawals during the surrender period are especially difficult. Normally, you're only allowed to withdraw about 10% of the annuity's value per year. Surrender fees are also sometimes charged by annuity companies.

Annuities also have the following drawbacks:

Another point of contention is the potential loss of returns. In the investment world, this is referred to as "opportunity cost" since you may not have a choice of more profitable options since it's harder to withdraw your money. This objection, however, will be valid for risk-averse people. In contrast, younger investors have more time to invest as they have longer investment horizons. Therefore, if they follow an aggressive investment strategy, they can bounce back from market losses more quickly.

For older investors and pensioners, opportunity costs should be considered. More specifically, they should take their specific circumstances into account. This particular age group tends to believe that declining opportunity costs are less of a disadvantage to annuities.

Although the optimal age to purchase a deferred annuity will differ for each individual annuitant, financial planners generally agree that between 45 and 55 is the best time. Combining compounded tax-deferred interest earned and the guarantee of lifetime income can provide a considerable retirement nest egg when used in conjunction with additional retirement savings vehicles.

When an investor is 45 to 55 years old, he or she will usually be able to take on more risk than an older investor because they will have more time to make up for any losses if they incur them. In addition, he or she is able to choose annuities based on their own risk tolerances and financial goals.

After age 59, annuity investors get rid of the 10% early withdrawal penalty imposed by the IRS. That means they are more likely to invest in an immediate annuity. Generally, an older annuity investor has the same options as a younger one. But, some of these options are more suitable to them due to the shorter time frame.

Does this mean you should avoid annuities in you’re in your 20’s or 30’s? Not exactly.

When you are young and getting serious about retirement, your financial situation and long-term goals will influence your decision whether to purchase an annuity.

If you're young, have short-term financial goals, and have limited liquid assets, an annuity might not be a smart choice. An emergency withdrawal from a savings account would be a better option in this scenario. You have to remember that taking money from an annuity early can be costly.

When looking for easy ways to diversify your retirement portfolio, you may want to consider equity indexes or variable annuities. A fixed annuity, however, still makes little sense if you are young, no matter what your situation because of its limited growth potential.

Many investors are wary of annuities because of the possibility they can not access their funds during the contract period. As a result, you may miss out on the chance to take advantage of higher interest rates in other retirement vehicles or to invest in a soaring stock market. Additionally, you also may be unable to withdraw this money without getting penalized in order to cover unexpected expenses.

It's here that you'll need to understand what your long-term goals are. In other words, in order to decide whether to purchase or sell an annuity, you must have clear goals and be comfortable with a modest payout in exchange for a lifetime income guarantee.

Conversely, waiting until interest rates rise before buying an annuity may cost you more than you realize. As annuities offer tax-free compound growth, the sooner you purchase one, the bigger your potential returns will be. In other words, you lose the future value of your money if you delay purchasing an annuity - or investing it in another way.

Consider investing a portion of your money upfront to reduce opportunity costs. Saving this amount will allow you to set aside some funds for unplanned expenses as well as take advantage of an interest rate increase in the future.

Another way to minimize your loss is using strategies like annuity laddering, as well as types of annuities, such as MYGAs, which do not lock you into one interest rate for the rest of your life. Furthermore, a 1035 exchange can also be used to switch to a new annuity contract with a better interest rate down the road.

Due writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

To ensure we’re putting out the highest content standards, we sought out the help of certified financial experts and accredited individuals to verify our advice. We also rely on them for the most up to date information and data to make sure our in-depth research has the facts right, for today… Not yesterday. Our financial expert review board allows our readers to not only trust the information they are reading but to act on it as well. Most of our authors are CFP (Certified Financial Planners) or CRPC (Chartered Retirement Planning Counselor) certified and all have college degrees. Learn more about annuities, retirement advice and take the correct steps towards financial freedom and knowing exactly where you stand today. Learn everything about our top-notch financial expert reviews below… Learn More